Is this the more profitable option?

Landlords across London will be considering setting up a limited company to negate the tax hit coming into effect in April – but is this the more profitable option?

Portico, London estate agents, have put together some worked examples and shared their thoughts on whether they think landlords should incorporate to pay less tax.

Changes to tax relief for residential landlords in April

“According to NLA research, 1 in 4 landlords are considering setting up limited companies. This is largely because, as of April, landlords with mortgaged properties owned personally will no longer be able to get the higher rate tax relief on all of their finance costs. Within a corporate structure however, landlords can continue to set their finance costs against rental profits.”Richard Blanco, multi-property Landlord.

Currently, landlords are permitted to claim tax relief on monthly mortgage interest repayments at the top level of tax they pay of 45%. From April however, mortgage tax relief is being restricted to 75%, and by 2020/21 only basic rate tax relief will be able to be claimed, regardless of your income level. This restriction is only for individual landlords; limited companies can still benefit from the full interest deduction.

So why might landlords want to use a limited company?

Companies benefit from favourable tax treatment of profits.

If you hold an investment property personally, your rental earnings are combined with your other earnings, such as income from your job, and then taxed as Income Tax up to 45%, (depending on your tax bracket). If instead you hold a property in a company, your profits are liable for Corporation Tax at 20% – potentially halving your tax bill.

Of course you’ll still pay tax on dividend when you draw profits from a company, but this is generally quite a tax-efficient method.

Worked example

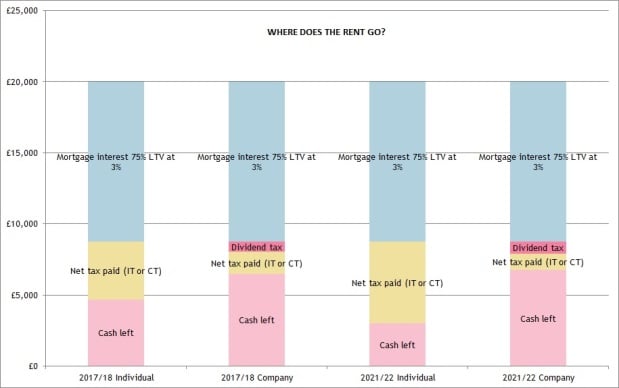

We asked Accounts & Legal for a worked example for a high rate taxpayer, using a £500,000 buy-to-let property with a 4% yield, a 75% loan to value interest only mortgage, and an interest rate of 3%.

As you can see from the graph, a company takes home £1,798 more cash in 2017/18 at £6,485, compared to £4,688 as an individual.

Furthermore, the tax on dividends (“Dividend tax”) is only paid if the cash is withdrawn from the company. If it is retained in the company and reinvested, the company would be an extra £715 better off again than the individual landlord in value terms.

By 2021 however, when the individual is only receiving basic rate tax relief on mortgage interest, there’s quite a big difference in take home cash. As a company you’ll pay corporation tax rather than income tax on the profit you’re left with after deducting all mortgage interest, which will leave you with substantially more cash after tax. And furthermore, the rate of corporation tax is set to decline by a further 1% to 18% in 2020, which will widen the gap even more.

What if the interest rate was higher?

When the interest rate is higher, the difference in profit between an individual and a company is even more pronounced. The table above shows a property with a 4% yield and a 75% loan to value interest only mortgage; the difference here is that the interest rate is higher at 4%. This shows that the cost of keeping the property in your own name rather than in a company increases dramatically with the mortgage interest rate.

It’s imperative therefore you shop around and ensure you secure the lowest possible mortgage interest rate.

Surely incorporating is the better option then?

From what we’ve looked at so far, a company structure certainly looks more tax efficient.

But not everyone will benefit from holding their property/properties in a company structure – especially not those who are already only paying the basic rate of tax (20%), or those without a mortgage.

“For landlords without another source of income or who are not high rate taxpayers, retaining the rental property personally allows them to utilise their annual tax-free personal allowance and basic rate tax bands – which may well be more tax efficient.” Chris Conway, Managing Director, Accounts & Legal.

Are you considering selling in the near future?

Incorporating your property portfolio also may not be the best decision if you are thinking of selling in the near future – as any gain will be subject to Corporation Tax when you come to sell.

The distribution of the post-tax retained profits in the company will then be subject to either income tax or capital gains tax, depending on how the funds are distributed, incurring an effective total rate of tax of between 42% and 44.7% for a high rate taxpayer. An individual on the other hand will only suffer capital gains tax on disposal of an investment property of up to 28%.

You also need to consider the cost of incorporating and ensuring the ongoing compliance of the new company. This includes filing annual accounts and an annual return at Companies House, and filing corporation tax returns with HMRC, which typically costs £500 to £1,000 per annum.

The cost of buy-to-let mortgages for limited companies

Richard Blanco also makes a good point regarding the cost of commercial mortgages: “It’s important to remember that buy-to-let mortgage rates start from 1.59% with a £1,995 fee and commercial rates start from 3.29% with a 1.25% fee, but are more typically close to 4%, so you would be paying considerably more interest if you incorporate. They are often repayment mortgages rather than interest only too. And remember, whilst corporate structures might offer some tax benefits now, the rules can be changed at the whim of the chancellor. You should put together a spreadsheet to calculate the difference in costs and make a decision based on actual figures and not a hunch.”

Here’s Richard’s worked example:

“A £300,000 mortgage at 1.59% would cost £4,700 in interest per year, and at 4% it would cost £12,000 per year. That results in £7,300 more per year.

You might find that this extra cost is more than the additional tax you will pay under the new regime if you own the property personally.”

So all in all, it really depends on the individual landlord…

Basically, yes. Though holding your property in a company structure can help guarantee your monthly tax bill, it may not benefit those who are lower-rate tax payers or those with only one rental property.

A better idea may be to cut your interest costs by re-mort

gaging and getting an up to date rental valuation on your property. Your lender will therefore have to recalculate your LTV, and a lower LTV ensures a better interest rate and a larger selection of lenders.

If you’d like a valuation on your rental property, or if you’d like to know how much it’s worth for sale, give Portico London estate agents a call on 0207 099 4000 or click here.

We would advise you to seek professional advice before making any financial decisions.

Leave a Comment